Industries | INSURANCE

Smarter insurance customer experience, powered by agentic AI.

Unify omnichannel communications and enterprise data to automate workflows while elevating policyholder experience. Customer Experience Automation (CXA) powers agentic AI self-service, employee assistance, and multi-agent workflows across policy servicing, claims, billing, and new business.

Purpose-built for insurance customer experience.

The CXA-powered contact center platform built for insurance comes with pre-built integrations to core systems and agentic AI pre-trained on insurance data. It unifies omnichannel engagement, intelligent routing, interaction analytics, and workflow automation — plus workforce, quality, and knowledge management — to streamline claims and policy servicing, empower employees, and elevate the policyholder experience.

Driving real results for insurance leaders.

“Talkdesk helps me achieve that empathetic, knowledgeable response across my team, even as Lemonade has scaled. The reporting features in Talkdesk help me keep track of every individual’s performance. I can easily see their average handling time, talk time, how quickly they picked up the call, and the length of the after-call work. We use all these metrics for our efficiency targets.”

Stephanie Baszulewski, Sr. Manager of CX Europe at Lemonade

Built for insurance, ready on day one.

Get insurance contact center software pre-configured for policy servicing, claims, billing, and new business workflows. Discover deep system integrations and pre-trained AI models designed to support insurance agents and adjusters from day one.

AI-powered automation that increases efficiency, not risk.

Built on Talkdesk Customer Experience Automation (CXA), Agentic AI streamlines claims processing and policy servicing while strengthening compliance and reducing fraud risk. With connected data and intelligent orchestration, human agents resolve cases faster, deliver more accurate service, and improve every customer interaction — safely and efficiently.

Omnichannel engagement that boosts satisfaction—and your bottom line.

Deliver human-like, multilingual self-service across voice, chat, SMS, and digital channels. Built on Talkdesk CXA, Agentic Autopilots automate insurance interactions across policy servicing, claims, billing, and new business—using biometrics and multi-factor authentication to enable secure, seamless policy changes, payments, and FNOL with empathy, accuracy, and compliance 24/7.

See how Talkdesk AI Agents for Insurance transforms every interaction.

Built on the Talkdesk Customer Experience Automation (CXA) platform, Talkdesk AI Agents for Insurance combines Agentic AI and Multi-Agent Orchestration to streamline policy, claims, and servicing workflows—reducing costs, improving satisfaction, and driving measurable results.

Integrations

Out-of-the-box and custom integrations for insurance.

certifications

The trusted choice for your contact center.

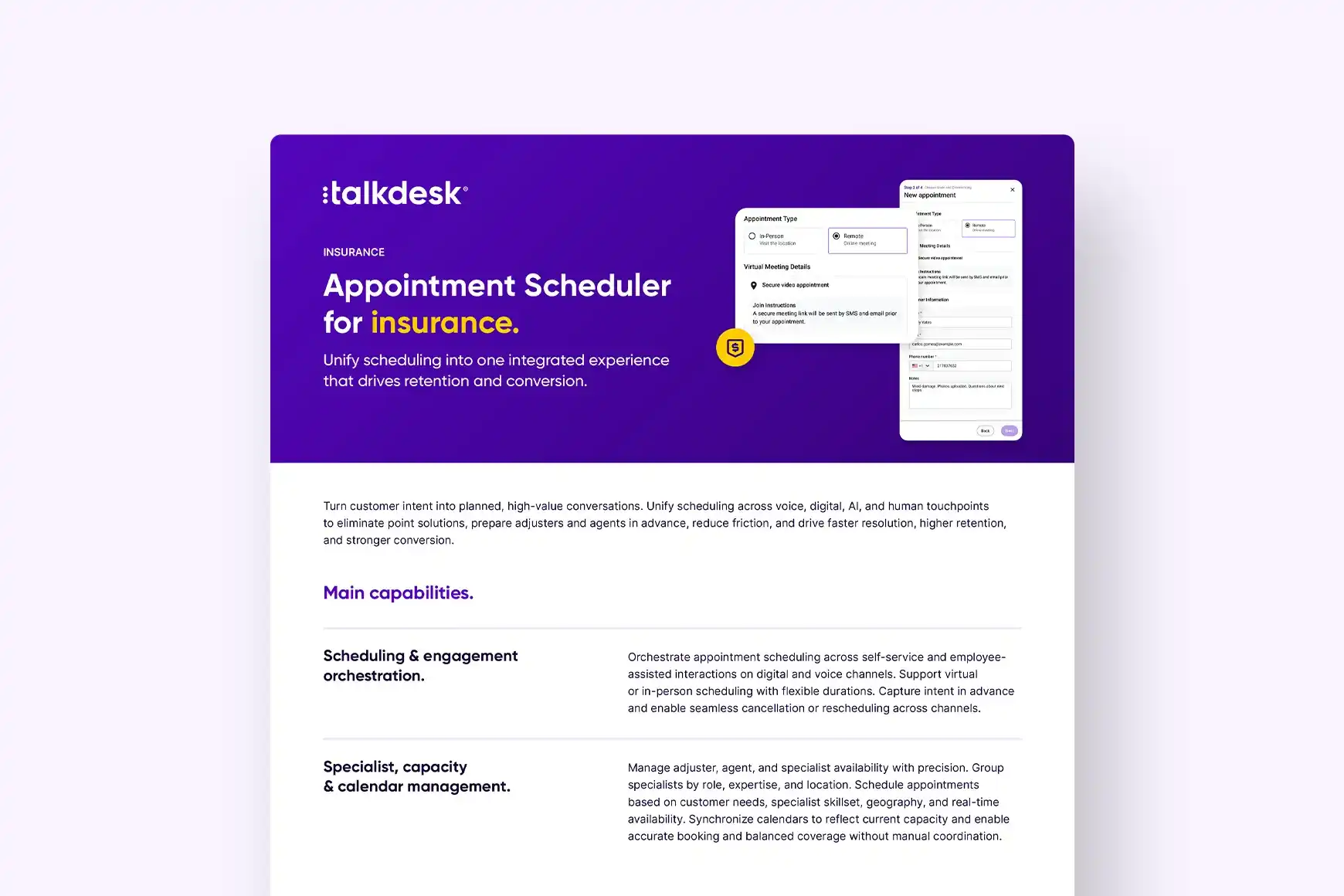

Related resources.

FAQs

Get the answers to your questions about insurance contact center solutions.

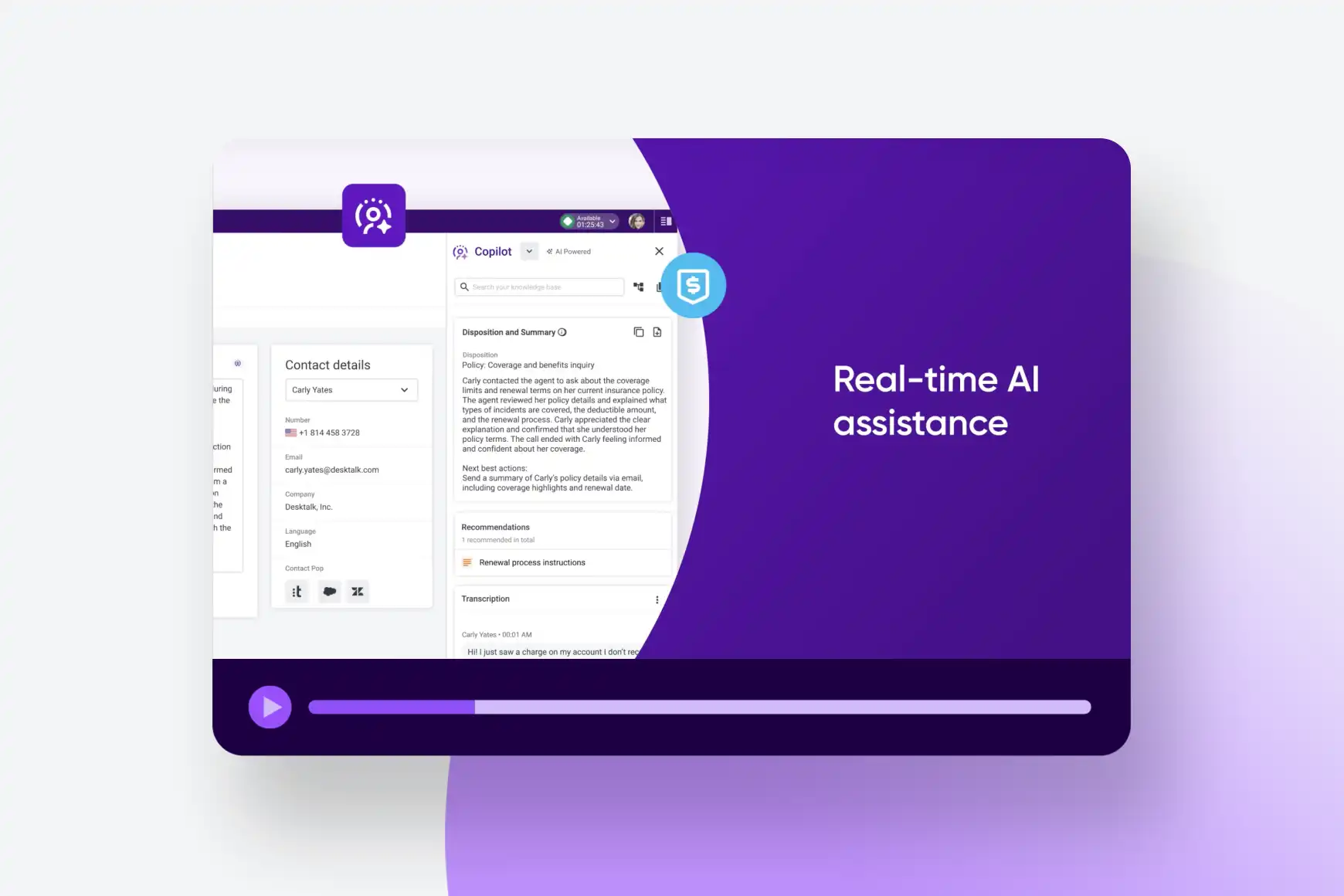

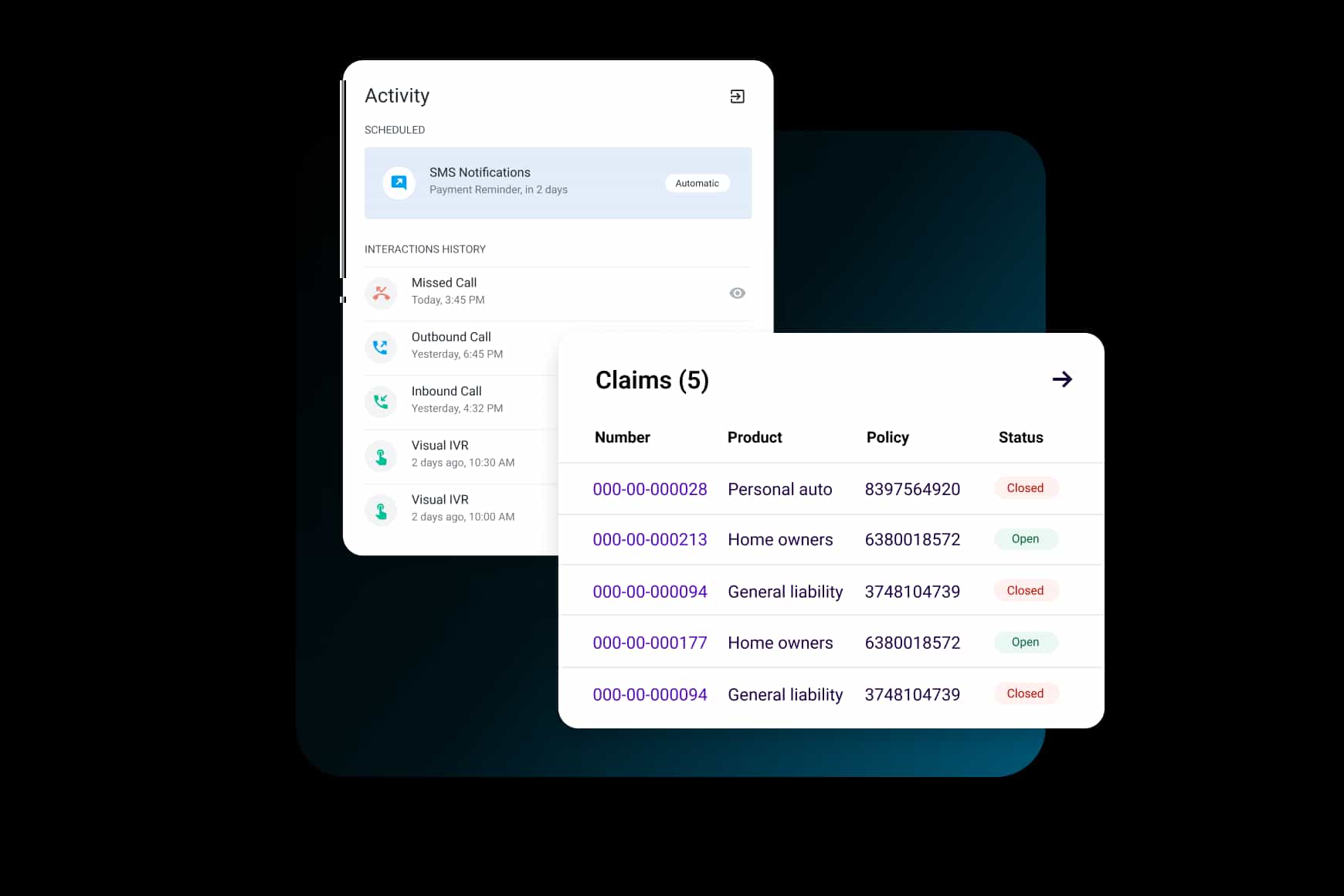

AI-powered automation personalizes every policyholder interaction in your insurance call center by intelligently routing customers, offering self-service options, and proactively engaging them via voice, SMS, and digital channels. Talkdesk Digital Engagement™ ensures seamless omnichannel interactions, while Talkdesk Copilot™ provides real-time guidance to agents.

Insurance-specific AI workflows allow policyholders to self-serve for ID card requests, policy changes, cancellations, and reinstatements. When human support is needed, Talkdesk Insurance Agent Workspace™ provides agents with a unified customer view to resolve requests quickly.

Yes, AI automates first notice of loss (FNOL), claim opening and closing, and general liability processing—reducing claims resolution times while ensuring compliance. Talkdesk Autopilot for Insurance™ also resolves common policyholder inquiries autonomously, escalating to an agent only when necessary.

AI-powered solutions reduce manual workloads, improve self-service adoption, and lower outsourcing costs by automating policy inquiries, claims processing, and payments. Talkdesk Self-Service Portal™ and Automated Notifications handle routine inquiries while freeing up agents for high-value interactions.

Talkdesk Shield™ protects insurers with real-time fraud detection, secure authentication, and regulatory compliance with PCI DSS, SOC 2, ISO 27001 standards. Automated monitoring and reporting also reduce compliance risks.

Talkdesk offers out-of-the-box integrations with PAS, CMS, and CRM platforms, reducing implementation time from months to weeks. Talkdesk Connections™ allows for easy integration with third-party systems.