Autonomous virtual agents: Soaring with Talkdesk Autopilot

By Pedro Andrade

0 min read

The future of customer experience is being defined by the trajectory of generative AI. It empowers brands to deliver personalized, data-driven experiences at scale, while dramatically improving contact center productivity. No matter what industry you are in, your customers expect fast and tailored AI-powered experiences; and, similarly, companies want to provide more self service experiences that can drive new revenue opportunities and increase productivity.

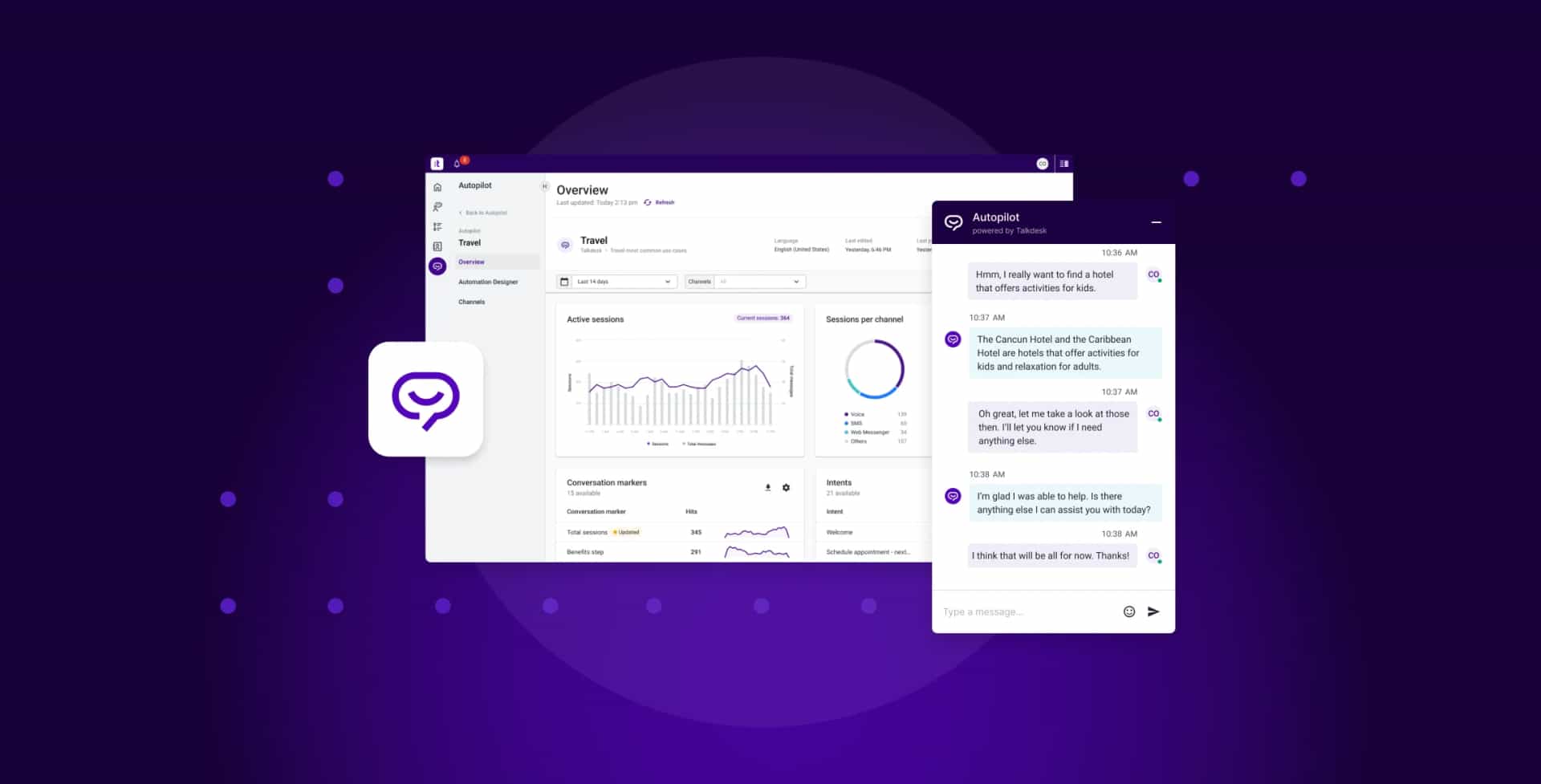

To help our customers meet these expectations and stay at the forefront of customer experience, we gave a major upgrade to our iconic AI-powered virtual agent. Talkdesk Autopilot™ builds upon and expands the AI-powered customer assistant capabilities of Talkdesk Virtual Agent. With the addition of new GenAI features, and prebuilt flows and conversations tailored specifically for retail, healthcare, and financial services markets, Talkdesk Autopilot can autonomously resolve complex use cases, understand a customer’s journey, and intelligently make timely decisions based on knowledge of that journey.

Designing successful AI conversations is a time-consuming and resource-intensive process that requires multiple iterations to resolve slight variations in customer queries. We lean on our extensive industry experience and large language models to build AI conversations that resolve the most common use cases in each industry—for example, stop payment or order fulfillment. Most bots simply deflect interactions, rather than resolve them autonomously. Talkdesk Autopilot, however, can intelligently search, review, and extract relevant information, based on the customer journey, and respond in a conversational way regardless of the complexity of the customer’s issue.

Companies that love their customers use Talkdesk, and we’re making it easy for our customers to get value on day one with the most common use cases already pre-configured in Talkdesk Autopilot. In addition to the preconfigured use cases, Talkdesk customers can also easily create conversational, customized AI flows to cover any other use case important to their business.

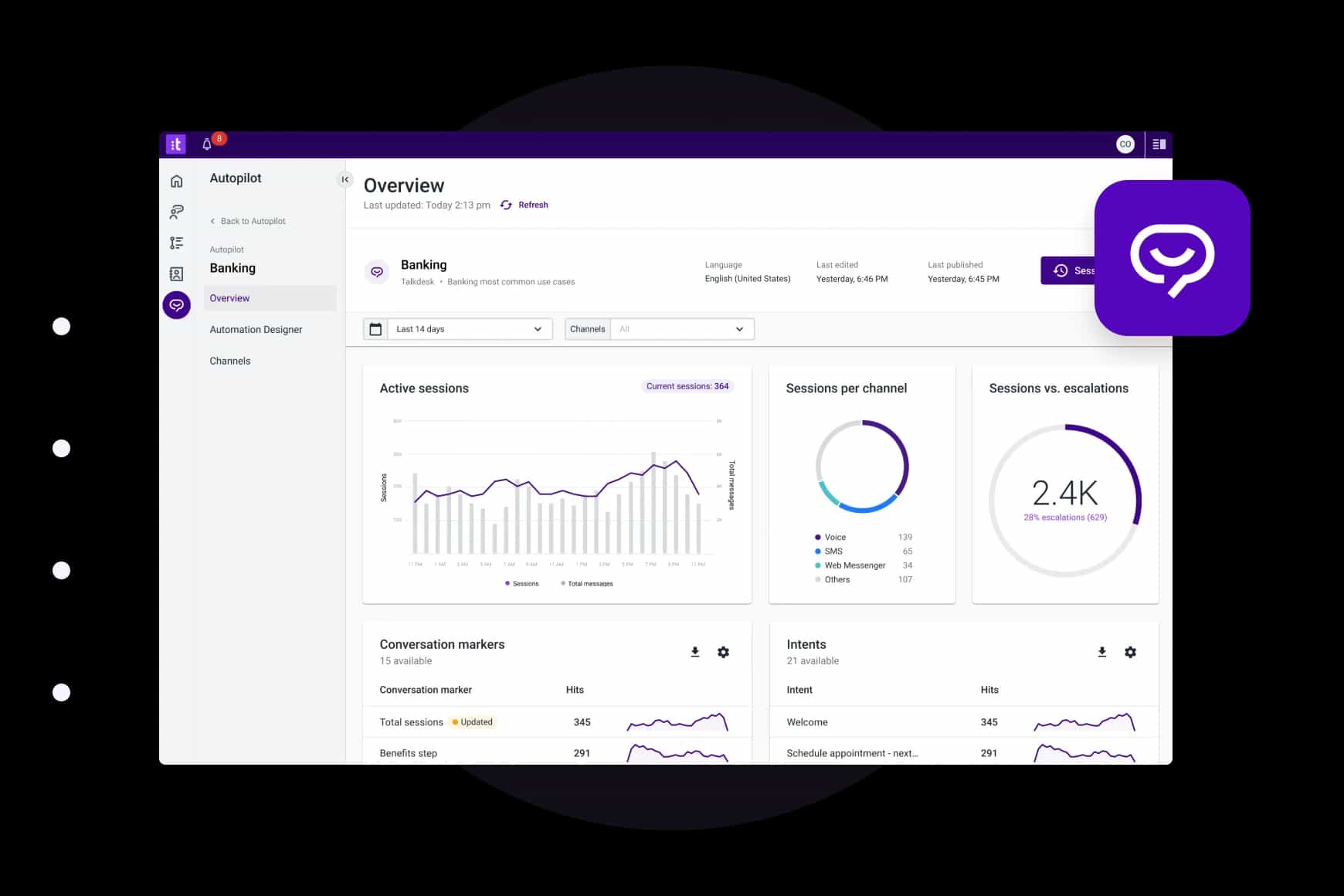

Talkdesk Autopilot virtual agent for banking.

Customers expect to engage with banks and credit unions using the channel of their choice or through self-service quickly and safely, regardless of the complexity of their inquiry. These expectations have pushed for a digital transformation in banking to adapt technology and embrace automated CX solutions to stay competitive while delivering superior customer experiences.

Talkdesk Autopilot for banking is a pre-built GenAI-powered virtual agent tailored for the industry. It seamlessly integrates with crucial banking systems, such as Fiserv, to automate complex transactional workflows that bring more context into the conversation and give members complete answers for their issue. Talkdesk Autopilot for banking can automatically help customers with several tasks, such as account balance, transaction history, transfer, and credit card inquiries. In addition to the preconfigured use cases, it gives CX departments the flexibility to quickly build and customize any conversation flow to improve personalization. For example, customers can use the bank’s digital platform to autonomously and effortlessly, through self-service, stop payments whether they’re paper checks, check sequences, or ACH transactions. Talkdesk Autopilot allows financial institutions to give customers full control of their account transactions in a completely safe environment.

Talkdesk Autopilot for banking: Customer use case.

Collins Community Credit Union was founded in 1940 with the philosophy of “people helping people.” That vision continues today by giving members in Iowa, Illinois, and Wisconsin a financial alternative to traditional banking and making a difference in the lives of its members, employees, and communities.

Talkdesk Financial Services Experience Cloud allowed Collins Community Credit Union to go digital to be able to provide a single, unified experience for members and employees. The level of detail and insight into their customer service operations was something they had never experienced before, and providing all member information to agents in a single pane of glass, rather than forcing them to switch between systems, revolutionized performance.

The results they’ve achieved after launching the Talkdesk Financial Services Experience Cloud are truly remarkable. For example, Talkdesk Autopilot handles their FAQs, significantly dropping call volume by over 50,000 calls—from 182,000 to 130,000—and abandonment rate by half—from 30% to 14.5%—in just one year.

Interested in learning more?

Connect with our team to see how Talkdesk can level-up your Call Center Software Solutions.

Talkdesk Autopilot virtual agent for retail.

Personalization is crucial in retail, as customers expect tailored recommendations, offers, and a seamless shopping experience across various touchpoints, whether online, in-store, or through mobile devices. We’re also all aware of the importance of addressing customer inquiries and resolving issues quickly and accurately.

Talkdesk Autopilot for Retail is the GenAI-powered virtual agent that allows customers to resolve issues quickly, easily, and seamlessly. It is available across digital and voice channels in the Talkdesk Retail Experience Cloud to automate common customer inquiries related to orders, deliveries, and shipments. Talkdesk Autopilot is also pre-integrated with e-commerce systems, making it possible to fully automate a broad set of use cases.

Talkdesk Autopilot virtual agent for healthcare.

Virtual agents have revolutionized patient care by providing real-time support to patients. Talkdesk Autopilot for healthcare brings GenAI into the contact center to deliver a unified patient journey, drive better outcomes, and provide seamless experiences all while alleviating the burden on contact center staff.

Talkdesk Autopilot is part of the Talkdesk Healthcare Experience Cloud for both voice and digital channels, allowing healthcare providers to deliver powerful patient and caregiver self-service throughout the patient journey. It solves patient issues automatically and seamlessly integrates with electronic health record (EHR) and other key systems platforms to provide patients with accurate and unified support.

Patients use Talkdesk Autopilot to self-serve from any touchpoint and perform several actions, from checking symptoms and locating the best provider to managing appointments, making PCI-compliant payments, prescription refills, and more, all connecting seamlessly to the healthcare contact center system.

Talkdesk Autopilot for healthcare: Customer use case.

Memorial Healthcare System is one of the largest public healthcare systems in the United States, and a leader in providing high-quality healthcare services to the residents of South Florida. Memorial’s patient, physician, and employee satisfaction rates are some of the most admired in the country, and they’re recognized as a national leader in quality healthcare.

Memorial Healthcare System had 12 separate, on-premises contact centers, each with different owners, processes, and with little to no integration. They embraced a unified contact center solution approach with Healthcare Experience Cloud, including the Talkdesk integration with Epic’s EMR software.

In addition to providing a unified and consistent experience, they have also significantly reduced average time to answer by 47%, decreased abandonment rate by 69%, and cut average handle time by 24%. After implementing Talkdesk Autopilot, they were able to automatically handle more than 50% of calls for password reset and 16% of appointment management (cancel, confirm, reschedule) were done through the virtual agent.

Closing thoughts on Talkdesk Autopilot virtual agent.

Talkdesk Autopilot virtual agent enables personalized, secure, and seamless customer experiences while creating efficiency throughout the contact center, regardless of industry.

- In banking, it empowers your customers with immediate assistance, accurate financial advice, and robust security measures.

- In retail, it provides personalized recommendations, streamlines transactions, and enhances customer satisfaction.

- In healthcare, it revolutionizes patient care with capabilities such as 24/7 support and seamless appointment scheduling, improving both access and outcomes.

Efficient, customized, and automated customer service is crucial for improving customer satisfaction and driving growth. See how Talkdesk Autopilot can transform your business.

DEMO

See Talkdesk Autopilot in action.

This self-guided demo will allow you to experience how Talkdesk Autopilot can autonomously resolve customer inquiries with laser-precise answers.