Insurance customer experience transformation from the front line

By Karin Martin

0 min read

In this special guest post, Karin Martin, assistant vice president and head of operations at Arbella Insurance, shares practical lessons from the operational side of insurance customer experience transformation.

Insurance company call centers typically handle high volumes of customer calls. Many of these interactions are transactional, while a considerable number of calls involve customers reporting claims. These calls can be very emotional, and range from something small, like a cracked windshield, to something more life-altering, like a house fire or a catastrophic loss.

That reality fundamentally changes how leaders should think about insurance customer experience transformation. Speed, accuracy, and compliance are essential, but empathy is just as important. I spent my career leading operations across front and back-office service functions, and one thing is clear: insurance contact center transformation brings people, processes, and platforms together to serve customers when it matters most.

For insurance leaders navigating service modernization initiatives today, experience has shown me that what looks good on paper doesn’t always translate into what works in practice.

If you still think of your contact center as a call center, you’re already behind.

Years ago, insurance organizations operated call centers. Customers called, and agents answered. If you hired great people, you delivered a decent experience.

That model no longer works.

Today, customers expect to engage on their terms—using voice, chat, email, SMS—and they expect interactions to be seamless and personalized with a sense of connection. Additionally, customer expectations are evolving across demographics. In a single day, contact center employees may service an 18-year-old digital-first customer and an 80-year-old policyholder on the same day. Both deserve an experience that feels intuitive to them. That’s why insurance contact center transformation must start with a mindset shift: from managing calls to orchestrating journeys.

When leaders design around channels instead of journeys, they create silos. When they design around journeys, they create continuity. The goal isn’t to push customers into digital channels or force them into voice but to meet them where they are – engaging in the way they prefer, without losing context along the way. This shift is what transforms a contact center into a true customer experience center.

Alignment beats technology every single time.

I’ve seen organizations invest heavily in modern platforms and still fail to make a meaningful impact. Most often, the reason is the same: misalignment.

Insurance customer experience transformation requires alignment that starts with C-suite executives and extends through operations and IT. Executive support means more than approving budgets. True sponsorship elevates the contact center from a cost center to a driver of retention, growth, and brand reputation. Alignment means IT and operations are working side by side, not in sequence, not in silos. It means starting with the customer journey first, even when the natural tendency is to focus on system constraints, security, or cost.

Effective transformations begin with the customer journey, and continuous measurement is critical. If you’re not regularly reviewing outcomes such as service levels, customer satisfaction, efficiency, or compliance, you risk stalling progress as expectations continue to rise. Technology enables transformation, but alignment sustains it.

Start with your employees if you want better customer experiences.

In insurance, employees often carry the emotional weight of a customer call, and most interactions involve a problem that needs to be solved. That’s why I firmly believe you can’t improve customer experience without first improving the employee experience.

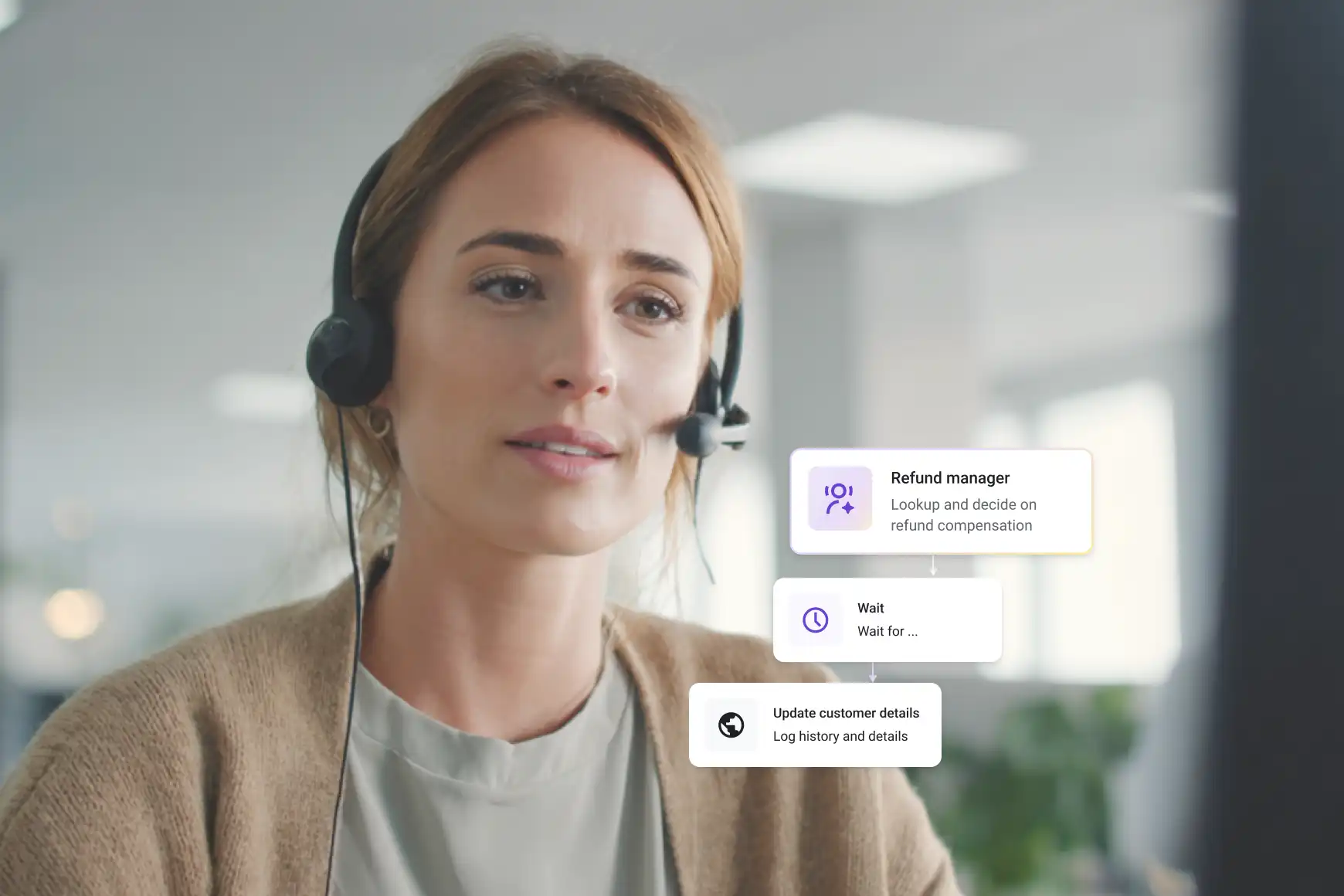

From an operational standpoint, that means removing friction wherever possible. Too often, service reps must search across multiple systems, knowledge bases, and repositories while trying to support a customer navigate a highly emotional situation. In addition to slowing things down, these situations result in frustration for both the employee and the customer.

Some of the most effective service delivery improvements are also the most practical:

-

Centralize knowledge so employees can find answers quickly and confidently.

-

Present compliance language in context, at the right moment in the conversation.

-

Make customer identification seamless from the start of the interaction.

-

Reduce handle time by eliminating unnecessary steps, not by rushing conversations.

This is where insurance contact center automation can have an immediate impact. When automation supports employees, it removes barriers and allows them to focus on listening, empathizing, and resolving issues more effectively. Empowered employees deliver better outcomes. It’s that simple.

What progress looks like when transformation is working.

Transformation is validated through measurable progress that demonstrates actual results. It’s less about a single metric and more about whether the right indicators start moving together. Service levels are often the earliest signal of improvement. When technology and workflows are aligned with employee workflows, responsiveness tends to improve quickly. In our case, we saw service levels improved 20% shortly after implementation, an early indicator that friction had been removed rather than shifted elsewhere.

Customer satisfaction is another important indicator, especially in the insurance industry, where CSAT scores are often already high. Even a 3% increase can be meaningful, typically reflecting that employees have better access to information and more precise guidance during emotionally charged interactions.

Efficiency metrics need context. We observed an average handle time decrease by 15 to 45 seconds, not because conversations were rushed, but because employees no longer had to search across multiple systems or interrupt the flow of a call.

Financial impact is another important measure. Expense savings is always important and typically follows when complexities and workarounds are reduced. In our service transformation, those efficiencies translated into approximately $1.7 million in savings.

Taken together, these excellent results demonstrate that our service delivery improvements are working.

Use contact center automation for insurance to create capacity, not distance.

Service automation can be misunderstood, particularly in customer-facing environments such as insurance contact centers. Many customer touchpoints involve emotional situations, and empathy and personalization are critical. When implemented thoughtfully, however, automation can enhance both the employee and customer experience within the contact center, creating capacity and allowing employees to focus on more complex, emotionally driven customer needs.

To begin the automated service delivery process, it is typically easier to start is with lower-emotion, transactional interactions, such as billing questions, payments, simple first notice of loss scenarios (like glass claims), policy lookups, or “how do I” questions. These interactions matter, but they don’t always require a live agent. When automation manages these effectively, it frees human capacity for the moments that truly require empathy and expertise, such as catastrophic losses, complex claims, or emotionally charged conversations.

As important as it is to automize service, there are moments when speaking to a live person is non-negotiable. Designing customer experience automation that can recognize those moments and route accordingly is essential to maintaining trust. Used correctly, insurance contact center automation strengthens the human connection instead of weakening it.

Move fast, but at a pace your organization can sustain.

Historically, many insurance organizations have struggled to keep pace with evolving service expectations and ways of doing business, even as technology has rapidly advanced. The growing gap is no longer sustainable. And transformation efforts that prioritize speed without intention can introduce more risk than progress.

The most effective insurance contact center transformation efforts strike a balance between momentum and responsibility. That means phasing delivery without losing urgency, introducing AI transparently, and bringing employees along at a pace that builds trust.

Starting internally, using AI to support agents through knowledge management, summarization, quality management, and workflow guidance, before expanding aggressively into customer-facing automation. This allows insurers to learn, measure, and adjust while protecting customer data and ensuring compliance.

The future of insurance customer experience is proactive, intelligent, and deeply human.

What is most exciting about where insurance customer experience is headed is the shift from reactive service to proactive engagement. AI and orchestration capabilities are opening the door to smarter first notice of loss experiences, intuitive routing that ensures customers reach the right resource faster, and “next best action” insights that help agents advise, not just process requests.

Even more compelling is the opportunity for proactive outreach. Whether it’s helping customers prevent loss or making them aware of coverage gaps before an issue arises, proactive engagement strengthens relationships and builds long-term loyalty. But none of this works without a strong foundation.

My advice to insurance leaders is simple: start with a unified, scalable solution that puts customer experience at the center—across every channel, interaction, and moment that matters. In insurance, your best customer isn’t the one who never needs you. It’s the one who does and remembers how you showed up.

CUSTOMER STORIES

Arbella Insurance

Expanding possibilities through AI-powered engagement.